The US has recorded a troubling signal for the dollar, — Bloomberg.

The US Dollar Index declines amid investors' outrage

The US Dollar Index experienced its worst week since November 2022, dropping by 2.4%. This occurred due to investors' fears regarding a potential slowdown in the growth of the American economy due to the country's trade policy.

Despite a constant increase in jobs, the rise in the unemployment rate in the US indicates a weakening labor market.

The decline in yields on US bonds is also putting pressure on the dollar, as it increases the likelihood of a loosening of monetary policy by the Federal Reserve.

At the same Time, as noted by State Street strategist Lee Ferridge, 'huge fiscal changes in Germany have raised expectations for growth in the Eurozone, and this has come at a time when concerns about growth prospects in the US have intensified.'

These changes in Europe have led to a strengthening of the euro, which is showing its best week since 2009.

Earlier in Poland, plans regarding the future of the złoty were revealed: will the country switch to the euro.

Read also

- EU and Canada to impose tariffs in response to $49 billion against Trump's duties

- Yellow level: residents of Kyiv region warned about dangerous weather

- Fighting in the Kursk Region: Syrskyi Revealed Massive Losses of Russians, and Putin Visited the Region for the First Time

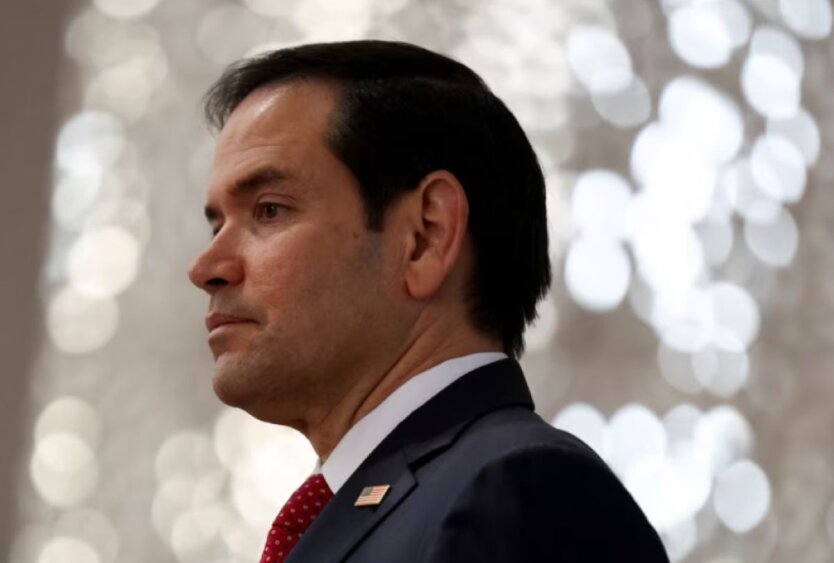

- NYT: Rubio said when the US expects a ceasefire in Ukraine

- Zelensky spoke about measures to improve strike drones and efforts for peace

- Trump's Conflict with Zelensky: Poll Shows What Americans Think