The gold market is frozen in anticipation of US data that will determine the exchange rate dynamics.

The price of gold remained stable after two days of growth. The reason for this was traders' reflections on a possible interest rate cut by the Federal Reserve ahead of the release of key employment data this week.

According to Bloomberg, gold was trading at a price of $2660 per ounce after a 0.5% increase on Wednesday. The report indicated an increase in employment and wages in the US private sector in December. Now the Federal Reserve will need to find a balance between this data and concerns about inflation when deciding on rate cuts, which was confirmed in the central bank's meeting minutes last month.

Of course, a reduction in interest rates benefits gold, which does not provide interest income itself.

Now traders are awaiting data on employment for December, which will be published on Friday. It is expected that the data will show moderate but steady employment growth, which economists predict will continue into 2025.

Last year, the price of gold rose by 27%, which was a record figure. This was partly due to the reduction of interest rates in the US. However, after Trump's victory in the elections, the dollar rate slowed down.

Read also

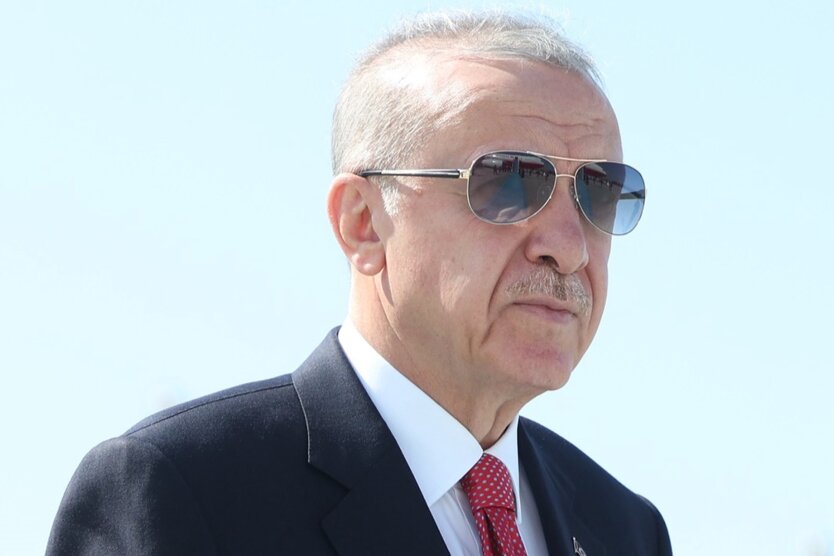

- Erdogan discussed the war in Ukraine with Trump: what Ankara demands in return

- Sibiha named the condition for ending the war in Ukraine this year

- Scholz hints at who can stop the war

- In Bryansk, a missile strike hit the base of the 'Kadyrovites'

- Stubbs pointed out Putin's true goals regarding Ukraine

- Syrskyi announced Russia's losses in the war against Ukraine since the beginning of 2025