Plan B: wealthy Americans want to move assets to Switzerland due to Trump's policies - FT.

Affluent Americans are considering relocating their assets to Switzerland due to the uncertainty surrounding Donald Trump's administration.

Private bankers and asset management firms are witnessing a significant increase in the number of clients wanting to open Swiss banking and investment accounts, especially those complying with U.S. tax requirements. According to a British co-founder of Maseco, the recent surge in interest was observed during the financial crisis when there were concerns about the bankruptcy of American banks. He stated that the current situation has arisen due to 'the uncertainty of Trump's presidency'.

One capital manager working with international clients is assisting a wealthy American family in moving between 5 and 10 million dollars to Switzerland. Geneva's Pictet private bank confirmed a 'significant increase' in demand among new and existing clients from the U.S.

Under U.S. legislation, citizens cannot simply open an account in a Swiss bank due to strict rules and a law requiring foreign banks to report U.S. account holders to the Internal Revenue Service. However, Swiss banks registered with the SEC can help clients open accounts and manage their money. Pictet bank is one of the largest Swiss players servicing American clients.

Legal Claims and Penalties

Since 2008, U.S. authorities have sued dozens of Swiss banks for assisting Americans in tax evasion through banking secrecy. This has led to substantial penalties for Swiss banks. In 2013, Swiss banks agreed to cooperate with the U.S. to avoid legal sanctions, enhancing transparency and exchanging information about U.S. account holders.

Read also

- Ukraine and Russia agreed with the USA on different conditions of the 'energy truce'

- Russians use a new deadly tactic of drone strikes

- It Will Last for 9 Months: Putin Prepares a Large-Scale Offensive against Ukraine

- Russia launched a ballistic strike on Kryvyi Rih: there are casualties and widespread destruction

- ISW Reveals Putin's Tactics in Peace Negotiations

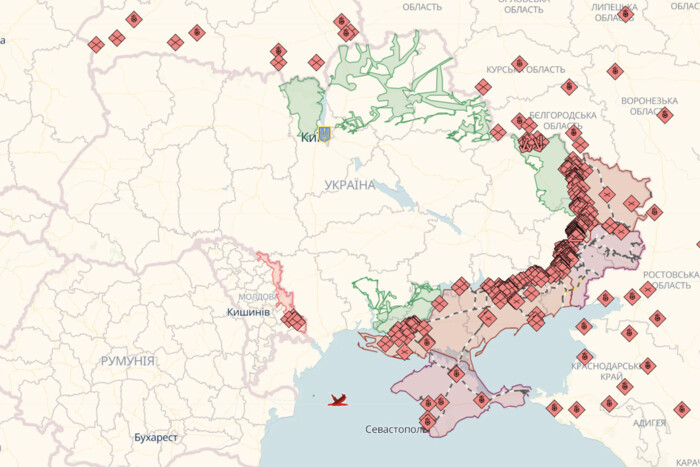

- Online map of hostilities in Ukraine as of March 29: situation at the front